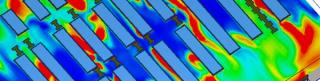

Computational Fluid Dynamics (CFD) modeling: A powerful tool to reduce data center energy use

by Brian Bakowski, Ian Todreas, Jim Hiller

View post

Does green hydrogen production have the potential to be scaled to make a significant contribution to achieving net zero UK by 2050 or will it remain a relatively niche application? This insight steps through the constraints and opportunities throughout the green hydrogen supply chain – from storage and transportation to the point of use and the potential for future consumption. We look at the UK’s potential as a green hydrogen producer, and some of the technical and policy hurdles which must be overcome to achieve a step-change in consumer uptake. Will the scale of domestic natural gas production and an existing distribution network mean blue, fossil-derived hydrogen outmuscles its smaller, greener brother, or is this just a temporary step in a gradual weaning from fossil energy?

Green hydrogen has the capacity to be a game-changer in decarbonising the energy system - but only if we can produce, deliver, and store it to required levels and there is more regulatory support. Policy is pushing the agenda, with the UK Government’s £166.5 million injection into green hydrogen production; however, we need to take a reality check on the predictions of those ready to supply hydrogen from fossil fuels.

One view is that whilst green hydrogen will be plentiful in 20 years, blue hydrogen is readily available for use now and can be produced where the infrastructure to transport it to end users already exists. But with blue hydrogen, carbon dioxide (CO2) is left over from production; capturing and storing this CO2 has serious cost and energy implications. Would it be reasonable to take any other fuel to market that comes with over ten times the mass of an inescapable waste product for every usable kilo, a waste product which requires an entire new industry – carbon capture and storage (CCS) – to manage?

Centralised hydrogen production and the distribution of hydrogen from fossil fuels at scale at least has the advantage of requiring relatively few CCS plants which can be closely managed and monitored. The landscape for green hydrogen production is, in the short term at least, in direct contrast and highly decentralised. A common potential application for green hydrogen production is onshore wind farms, where energy constrained by electricity grid conditions can be used instead to generate hydrogen by electrolysis as an energy storage medium.

We sometimes see casual references to ‘adding’ green hydrogen to a renewables project and indeed this can be an elegant solution to get best value from constrained energy production. However, adding hydrogen infrastructure must be thought through very carefully and is not always the optimal solution. Green hydrogen isn’t yet transported in the same way as blue hydrogen will be, from an industrial facility where it is created from fossil fuel feedstock and where the infrastructure for bulk or pipeline transportation already exists. Green hydrogen might well be made in the middle of nowhere, and so the location of the hydrogen electrolyser is key. It must ideally be made where conditions for renewable electricity generation allow, where the production facility can be safely and responsibly located, and where the off-taker can be easily reached. Once the green hydrogen application is determined, for instance pumped into fuel cell applications for motive power or for thermal use as a fuel for a boiler, the operator must work backwards to establish the storage and generation infrastructure required. Three things, however, must line up perfectly; a renewable energy source, the optimum site location, and a customer.

At the moment, there is a small overlap on the green hydrogen Venn diagram. New market entrants can’t mitigate the risk of producing green hydrogen without clear demand, and storing and transporting to that ‘customer’ is a key challenge. But that sweet spot is growing – as the technology and market matures, more is known and business cases are becoming more robust. Whilst today’s immediate customer applications are modest: fuel cells for vehicles and machinery, and limited thermal applications for industry, the potential market is vast, with the chemical industry, thermal power generation, domestic heating, aircraft, rail and sea freight all lining up to take advantage as soon as they can.

Green hydrogen is conventionally stored in pressurised static tanks and, where geological conditions permit, there have also been successes using steel-lined underground cavities. However, the transport of green hydrogen poses some difficulties. Where it is created, on windy Orkney or Shetland for example, is unlikely to be where people need to, or at least can, use it in the quantities generated. Being the lightest substance in the universe and requiring a lot more molecules to burn to give the same outcome as fossil gases, means that transporting a meaningful supply can be challenging. For small quantities, transport in pressurised cylinders in a road tanker is current practice. However, long-haul transportation is unlikely to be sustainable at scale – a 42-ton road tanker for at most a half-ton payload is a lot of hardware for very little gas, not forgetting the energy required to move the vehicle. The alternative then is pipelines, but these have physical and geographical constraints, as well as construction costs for the pipeline itself and compressor stations along the route, hence the current presumption is for green hydrogen production facilities to be sited close to the consumer.

The emergence of light and effective liquid organic hydrogen carriers and particularly solid-state storage will be a game-changer for long-haul hydrogen transport, with trucks then able to carry quantities of hydrogen well in excess of what is currently possible.

The UK has an ambitious target of at least 5GW of renewable and low-carbon hydrogen production capacity by 2030. But without a clear market with known demand for green hydrogen, developers and investors are nervous to commence projects, meaning that many plans remain speculative or are contingent on grant funding.

In terms of legislation, hydrogen production is governed by the same permitting regulations as other industrial and thermal plant. An electrolyser in the context of the Environmental Permitting (or PPC in Scotland) regulations is a very small hydrogen factory and there is no de minimis for the application of the regulations, though the regulatory burden is greatly reduced for smaller units. If you have an electrolyser over 3MW electrical, you must follow the same fundamental permitting procedure as you would for a 1GW gas plant. A review of permitting regulations, to ensure the application process and regulatory burden is proportional to the environmental risks posed by the electrolyser and hydrogen storage, will be needed to avoid a logjam of applications and make project timelines more predictable.

Green hydrogen projects only progress with a pre-determined supply chain and all logistical elements mapped out. Whole-project feasibility studies and a holistic approach to project and programme management are key to the success of any project. At present, hydrogen is more expensive as an alternative to natural gas and does not attract any subsidy, though this is anticipated in the near future. The tipping point is coming – right now we’re experiencing the learning phase, and watching as the sweet spot of overlap in the Venn diagram – site location, transport and end user – expands rapidly. As off-takers increase, greater numbers of production sites will look less marginal and the commercials will stack up better.

New plants already exist (for instance in Australia) to convert renewable energy and water into further fuels, with power-to-X seeing hydrogen and its derivatives, like methanol and ammonia, being produced. These key fuels have significant potential to free transport, heating, and industrial process from fossil fuels. First choice of these sister-fuels is ammonia which is still a clean thermal fuel even if its calorific value is relatively low; it can more successfully be used for chemical feedstock and can be reconverted to hydrogen if required. Since ammonia can be kept in liquid form at low pressures, your road tanker can now carry 30 tons of ammonia rather than the alternative half-ton payload of green hydrogen because you can use a more conventional liquid chemical tanker to move it. It can even be combined with another producer’s carbon dioxide and turned into methanol, again for chemical feedstock, with the right plant.

Green hydrogen has huge potential as a green energy source from an application perspective, but despite a growth of projects at feasibility stage, only a tiny amount of green hydrogen exists for commercial sale from small production facilities within the UK. Other countries such as Australia, with its vast solar energy resources, have beaten us to large scale green hydrogen production but the UK has its own abundant resource in wind. Replicating and sharing project models where the fundamental availability of clean energy allows, will serve to educate regulators on the commercial realities and parameters for green hydrogen production. All is moving in the right direction for green hydrogen renewables projects, albeit still at a premium level for now, to become a commodity fuel.

This article featured in Energy Voice magazine.