Unlocking value through solar PV repowering: A focus on module replacement and DC/AC optimisation

by David Fernandez

View post

RCS Global - part of SLR - published a report in 2017 entitled The Battery Revolution: Balancing Progress with Supply Chain Risks. The purpose of the report was to provide an overview of the responsible sourcing challenges associated with the opportunities of increased demand for battery energy storage systems, particularly in the electric vehicles ('EV') sector. Since the paper’s initial publication, the global lithium-ion ('Li-ion') battery market has transformed under the influence of evolving competition, a new regulatory landscape, and evolving supplier expectations. The purpose of this article is thus to explore some of these trends and describe the developments and remaining responsible sourcing challenges across the EV and battery manufacturing sectors.

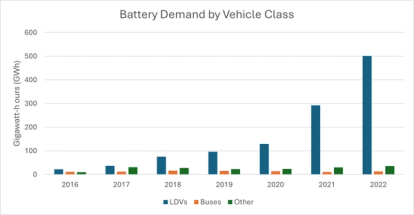

The market for battery materials has seen dynamic growth since 2017, driven largely by end uses in electric vehicles and renewable energy storage. Projections of a doubling in the lithium-ion battery segment have generally surpassed expectations, particularly in the EV sector where demand increased nearly 14 times between 2017 to 2022 alone (Figure 1) [1].

Figure 1. Battery demand by vehicle between 2016 to 2022, IEA (2022) Global EV Outlook

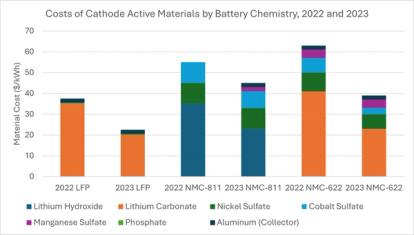

High-nickel batteries like NMC (nickel manganese cobalt) remain the most common chemistries in European and American car markets while LFP (lithium iron phosphate) are most prevalent in the Chinese EV market [1]. While NMC batteries still have higher energy densities which allow for longer driving rangers, LFP batteries have seen a notable increase in global market share largely due to their price advantage. The low-price environment in lithium chemical prices throughout 2023 and 2024 compared to 2022 highs has also boosted the competitiveness of batteries with higher lithium content (Figure 2).

Figure 2. Costs of active cathode materials between 2022 and 2023, by battery chemistry, S&P (2024) Lower lithium prices support adoption of lithium-rich EV batteries

As a result of regulatory, market, and consumer habit tailwinds, analysts expect LFP to continue gaining market share, especially as automakers prioritize cost-efficient production. Projections indicate that NMC batteries will see their market share shrink from 51% in 2022 to 42% by 2030, while LFP is forecasted to grow from 38% to 41% over the same period [2].

China

By 2020, more than two-thirds of global EV Li-ion battery production capacity was in China; between 2014 and 2020, China’s EV battery production capacity expanded from 4.4 GWh to 80 GWh [3]. Chinese battery manufacturers are also expanding globally, capitalizing on international demand by increasing exports and setting up production facilities abroad. The expansion has been supported by consolidation, industrial policy, and international trade in recent years.

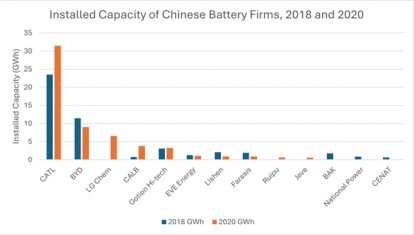

The Chinese battery industry has witnessed an intense period of consolidation within the last decade. In 2015, the country had around 240 battery manufacturers which was truncated to around 50 in 2020, where ten battery firms accounted for around 92% of the total market compared to about 83% two years prior (Figure 3) [4]. The trend has assisted several leading battery manufacturers in developing price advantages based on economies of scale while establishing well-funded and more centralised R&D programs. As a result, Chinese battery cells are viewed as a cheap and safe option for automakers worldwide [5].

Figure 3. Installed capacity of Chinese battery firms, comparison between 2018 and 2020, The Bridge Tank (2022) How China came to dominate the global EV lithium-ion battery value chain

The Chinese government has provided subsidies across its new energy vehicles sector since 2009, including buyer rebates, sales tax exemptions, and infrastructure funding (mainly for charging stations). Chinese battery manufacturers are also expanding globally, capitalizing on international demand by increasing exports and setting up production facilities abroad. Major players like CATL and BYD have invested in overseas factories, with CATL starting production in Germany in 2023 [6].

As highlighted in our 2017 report, China continues to play a central role in the global battery materials supply chain, as it maintains its position as the largest processor and exporter of lithium chemicals, cobalt, and graphite.

USA and Europe

The EU and USA are simultaneously expanding their battery sectors to capture the economic benefits of EV a localized EV value chain, targeting more regional upstream manufacturing and domestic battery production facilities. North America has been particularly successful in capturing EV-related investments – a study by Transport&Environment concluded that 37% of global investments between 2021 and 2023 was allocated to the region largely due to subsidies from the IRA [7]. As a result, growth in US battery factory projects has increased from four battery plants that were either operational or under construction in 2019 to over 34 planned, operational, or under construction in 2024 [8].

Given the ambitious industrial policies laid out by European and North American governments like the Green Deal and Inflation Reduction Act, the two continents are projected to house nearly 20% of global battery cell production by 2030. However, the regions still maintain a small share of the upstream component market – producing minimal quantities of core cell components compared to Asian producers, who account for 96% and 95% of cathode and anode active material output [9].

From voluntary to mandatory requirements

In our 2017 report, we highlighted how responsible sourcing in the battery industry was becoming a focal point for regulators.Eight years later, key regulatory developments in both the EU and US are already reshaping how companies need to approach a broad scope of sustainability issues in their supply chains, including supply chain due diligence.

The EU Battery Regulation, adopted in July 2023, places a new focus on the battery lifecycle from sourcing raw materials to recycling and reuse. Under the regulation, manufacturers will be required to provide detailed data on the battery cell’s carbon footprint, recycling content, and material sourcing practices. These practices demand stronger supplier engagement practices and automakers are already revising their due diligence management systems and data collection processes to align with the regulation. This dovetails with the European Union’s Corporate Sustainability Due Diligence Directive ('CSDDD') which was published in July 2024 and broadly requires large companies to conduct thorough environmental and human rights due diligence throughout their supply chains. Meanwhile, the Critical Raw Materials Act was presented in March 2023 and seeks to secure a secure supply of critical materials while minimizing reliance on environmentally harmful or unethical mining practices. Together, these EU regulations will shape the landscape of the battery market across Europe.

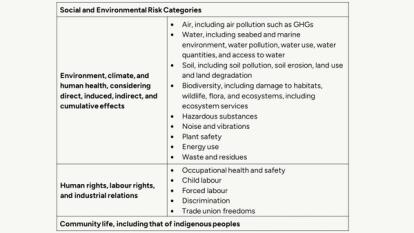

These regulations have broadened the scope of risks that companies must manage throughout the battery supply chain. For example, the EU Battery Regulation includes broad ESG risk categories (Table 1), while the EU CSDDD refers to a list of internationally recognized environmental conventions and human rights agreements. This differs significantly from existing frameworks in 2017, such as the OECD Due Diligence Guidance, which focused primarily on specific human rights abuses and business ethics.

In addition to expanding the risk scopes, these regulatory developments have also introduced mandatory responsible sourcing requirements for raw materials other than 3TGs (tin, tantalum, tungsten and gold), thus broadening the supply chains affected. In the case of the EU Battery Regulation, for example, due diligence requirements focus on lithium, cobalt, nickel and natural graphite.

In the United States, the Inflation Reduction Act (IRA) takes a different approach by applying financial incentives to encourage domestic production or sourcing from partners with a free trade agreement, although no clauses for due diligence are stipulated. Tax credits for electric vehicles and battery manufacturing are offered, with their full benefit only accessible when strict requirements regarding raw material sourcing in North America or countries with free trade agreements are met. The IRA thus ties financial rewards to domestic production, incentivizing localized supply chains and transparency.

Critical Minerals Tunnel Vision Leaves Mica Risks Overlooked

The introduction of regulations presents both an opportunity and a challenge. The benefit of regulations which target an explicit set of raw materials is that corporate boards, executives, and practitioners clearly understand where their focus “should” be for human rights due diligence – in addition to what results of their actions “should” be expected. However, the risk of such a narrow focus is that many high-risk raw materials used in EV production, such as mica, will bypass the attention of decision makers; due diligence as a result could become a box-ticking exercise. It would be remiss to assume simply because cobalt, lithium, nickel, and natural graphite are now of regulatory focus, that risks elsewhere do not exist and do not require the same, or greater, level of attention.

One of the minerals not covered by most regulations is mica, a key raw material in the production of an EV battery. Once easily sourced from Russian industrial mines, mica now poses a challenge as companies alternatively procure it from artisanal and small-scale mining (ASM). This shift necessitates company engagement due to the direct inclusion of ASM production in their supply chain.

For many artisanal mica miners, living conditions are extremely precarious and their main source of income often originates from mica mining. The mineral also bears low bulk prices, especially compared to the cost of available food.

RCS views mica to currently be in the same stage as cobalt in 2016, with initiatives and working groups now being established for swift responses. The key difference now is the level of competition for corporate attention, budgets, and efforts due to the regulatory requirements for due diligence on other raw materials, leaving mica at risk of being deprioritized compared to regulated minerals.

In the absence of clear regulations pointing companies where to direct their resources, it is imperative that companies look beyond narrow mineral scopes and address pressing risks in their supply chains. To offer children a pathway to a better future and remediate critical risks the mica sector needs active participation and practical engagement from all actors in the value chain. This includes investment in child labour remediation, improvement of occupational health and safety conditions on mines, and collaboration with the development sector, industry, and government.

Lack of unified producer assessment criteria

In 2017, a dangerous unknown was a lack of widely agreed upon responsible sourcing standards or reporting frameworks for battery materials. While many assurance standards have undergone revisions to specify their scope and ratchet up requirements, there still exists a lack of unified producer assessment criteria.

Initiatives and standards have been introduced and revised to reflect changing expectations from the battery value chain. In this sense, assurance mechanisms have been relatively adaptive to market expectations. For example, the Global Battery Alliance introduced the Battery Passport initiative in 2020, aiming to ensure consistency in the industry’s approach to promote a responsible battery value chain. The RMI has similarly updated its tools, with the third version of its Risk Readiness Assessment having been published in January 2024.

On the other hand, as upstream initiatives have become more widely adopted across a variety of actors along the value chain, tensions between ambition levels have become clear. To illustrate, many downstream automakers with advanced supplier codes have largely adopted IRMA as a standard requirement while upstream actors more widely support ICMM, TSM, and the Copper Mark. Consequently, the ICMM, TSM, and the Copper Mark are merging to form a single consolidated mining standard initiative (CMSI) that is widely intended for uptake among existing upstream participants. The CMSI’s first draft standard is expected to be released in Q4 2024.

Lack of fully investigated supply chains

Certain battery material supply chains remain complex and opaque, although significant progress has still been made in investigating risks and transferring due diligence obligations to suppliers and sub-suppliers. The regulatory landscape has changed considerably since 2017, with new laws that impose accountability onto companies for failing to identify and mitigate environmental and human rights risks in their supply chains.

In preparation for mandatory due diligence, companies are imposing stricter requirements on suppliers; major automakers are starting to expect complete disclosure from the mine-level for all new contracts of battery materials as early as 2020, with many requesting suppliers align themselves to the Initiative for Responsible Mining Assurance (IRMA) in Supplier Codes. In addition to transparency and performance clauses in supplier contracts, automakers are further investing upstream, with several investing in early stage raw material projects to secure reliable and discounted material offtakes.

In addition to direct supplier engagement, a range of traceability solutions that track material flows or assess supply chain risks have entered the market. While physical tagging systems have been implemented as early as 2011, providers are increasingly offering digital solutions to track global trade data and enable material inventories for proprietary data. Chain of custody standards additionally guide companies in tracking materials from audited mine sites and processors through to market. IRMA released its first Chain of Custody standard in 2020 and is currently undergoing a draft review process for a second version.

Challenges related to supplier engagement

As the industry tends towards greater accountability, some suppliers have been hesitant to fully engage due to competitive concerns and resistance to audits.

Competitive concerns have arisen over fears of disclosing proprietary information that could jeopardise intellectual property. Suppliers working with multiple clients may worry about inadvertently revealing strategic details that could give competitors an advantage. Additionally, some suppliers maintain an unwillingness to participate in audits, stemming from concerns over operational disruption and incurred costs. While audits are essential to verify regulatory compliance as well as adherence to OECD frameworks, many suppliers resist them due to concerns over exposing internal practices that might not align with such requirements. Supplier engagement is already strengthening in the midst of regulation which imposes civil liability for companies that failed to perform adequate due diligence. Transparency initiatives like the Extractive Industries Transparency Initiative (EITI) are also lowering barriers to encourage greater engagement across the industry.

Conclusion

The battery supply chain has undergone a significant transformation since 2017, driven by intensified regulatory pressures and evolving industry expectations around responsible sourcing. The EU and US now require more stringent due diligence and transparency requirements to companies that operate or sell in their markets, leveraging greater disclosure on environmental and human rights risks around the world.

While more recent initiatives like the Global Battery Alliance’s Battery Passport and the forthcoming Consolidated Mining Standard Initiative represent progress towards unifying the industry’s approach towards sustainable battery production and responsible sourcing, challenges still exist in converging upstream and downstream expectations. As global demand for lithium-ion batteries continues to increase, actors in the battery industry must navigate this new environment and proactively enhance accountability across their operations and supply chains.

--------------------------------

References

[1] https://www.iea.org/reports/global-ev-outlook-2023/trends-in-batteries

[2] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/lower-lithium-prices-support-adoption-of-lithium-rich-ev-batteries-80627369

[4] https://thebridgetank.org/wp-content/uploads/2023/06/Policy_brief_CHINA-EV-2.pdf

[7] https://www.transportenvironment.org/articles/carmakers-ev-investments-is-europe-falling-behind