S&P Global’s Corporate Sustainability Assessment: The Results

- Post Date

- 21 November 2023

- Read Time

- 8 minutes

Now that the dust has settled around S&P Global’s Corporate Sustainability Assessment (CSA), one of the most well-established and reputable benchmarks of Environmental, Social and Governance (ESG) performance, you might be one of the 13,000 companies reviewing their results from this year’s CSA.

The score is of course the one thing that captures everyone’s attention at first glance, but as you dig into it, there is so much more to it. Whether you are a seasoned CSA participant or new to the process, you want to be able to maximise benefits and ensure you learn from the process. From our experience, there are several key things you can start doing today to action your results effectively.

What is the CSA? And why does it matter?

The CSA is an annual assessment of ESG performance based on financially material sustainability indicators, weighted to reflect what matters most in your industry. The results are used by hundreds of thousands of stakeholders every year – ranging from investors looking to inform investment decisions, to Non-Governmental Organisations (NGOs) and other non-financial stakeholders interested in company sustainability performance and by companies themselves to gain a better understanding of their own sustainability journey.

But, why does it matter?

The CSA has some clear, tangible benefits for companies responding to it:

- Ensuring long-term success: The CSA clearly establishes a link between a company’s sustainability performance and its long-term success, with questions evolving to reflect changing practices and financially material topics, weighted accordingly.

- Encouraging internal collaboration: The process encourages internal collaboration, triggering cross-functional conversations that may not have otherwise occurred. This process transforms data-gathering into an opportunity for innovation and idea exchange across business units and functions.

- Improving sustainability data management: Going through the CSA process and improving disclosures on an annual basis can support in streamlining and enhancing future sustainability data management and reporting.

- Attracting investment: Performance in the CSA will signal your sustainability maturity to the market and potentially open the door to attract investment from the rapidly growing responsible investment market.

- Enabling global-scale industry benchmarking: The CSA score platform offers deep insights into your sustainability performance, against industry averages and best-in-class performers worldwide, serving as a valuable tool to learn from, identify areas for improvement, and prioritise actions.

What do these results mean? And where do we go from here?

If you’re asking these questions, you’re on the right track.

While the CSA is often described as an annual examination, it’s important to note that the process extends beyond a one-off evaluation. It is instead, an iterative process encouraging continuous improvement year after year. Your CSA scores act as valuable indicators for highlighting existing strengths and areas for improvement when compared to your industry peers. More importantly, they serve as an important starting point for initiating actions aligned with evolving reporting requirements.

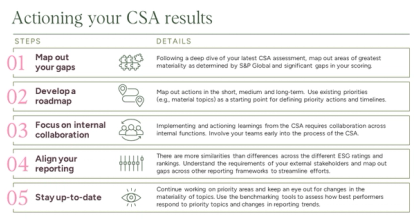

Although many CSA reporters understand the value of their CSA scores, a common challenge is translating results into practical steps for improvement. To effectively action your CSA results, we recommend implementing a structured process for improvement that involves these 5 key steps:

1. Map out your gaps

The CSA evaluates a range of industry-specific criteria and questions. However, not all of these questions will be of equal priority for your organisation. Following a deep dive of your latest CSA results, it is imperative to identify the most material areas and significant gaps in your performance. This process should be guided by questions such as:

- How did we perform against each topic?

- How material is this topic within our industry? (This question can be guided by the CSA methodology)

- From our own materiality review, how much of a priority is this topic?

- What is the gap between our company’s performance and the industry’s best?

As illustrated below, this exercise provides a clear understanding of where your company stands in comparison to industry benchmarks and a snapshot of key gaps to close, enabling targeted efforts towards improvement.

2. Develop a roadmap

To translate insights or gaps into actionable strategies, it is essential to create a roadmap that outlines short, medium, and long-term actions. When developing a roadmap, companies need to focus on defining clear and measurable ambitions against each topic and translating these into concrete actions and milestones. This ensures a clear step-by-step, year-on-year trajectory of improvement. To guide this process effectively, consider the following questions during the development of your roadmap:

- What practical ambitions will we need to set against each topic?

- Based on these ambitions, what specific actions will help close the gaps?

- What realistic timelines are needed to make progress?

- Do these timelines align with internal priorities and stakeholder expectations?

A well-structured roadmap will serve as a guiding framework for sustainable progress.

3. Focus on internal collaboration

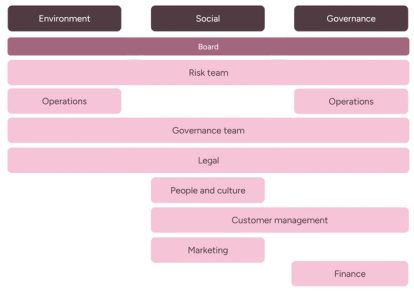

Implementing and actioning learnings from the CSA necessitates collaboration across internal functions. Engage your teams early in the process and work through the results together. Address the following questions when mapping out teams to involve:

- Who is directly responsible for each topic?

- What other internal stakeholders should be involved?

- What is in it for them?

- How can improvement efforts be integrated into existing processes and decisions?

Effective internal collaboration ensures that sustainability initiatives are seamlessly integrated into the fabric of your organisation.

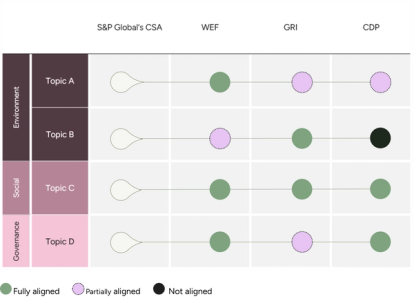

4. Align your reporting

Responding to the CSA can feel like an extensive task, requiring companies to double up on efforts across different reporting requirements. However, the CSA is designed to take into account key standards and frameworks such as Global Reporting Initiative (GRI), Task Force on Climate Related Financial Disclosures (TCFD) and United Nations Principles for Responsible Investment (UN PRI), indicating overlap and opportunities for utilising information from already existing company disclosures.

Understanding the alignment of your CSA submission with other reporting requirements will help minimise duplication of efforts and ensure consistency across your disclosures. When aligning your CSA reporting with other requirements, you may want to consider questions including:

- What frameworks and standards matter most to us for disclosure?

- What are the commonalities across the reporting requirements?

- What are the outstanding gaps?

- How can we leverage our CSA responses to streamline efforts and ensure we meet multiple reporting requirements?

A cohesive reporting approach demonstrates a unified commitment to sustainability across various platforms.

5. Stay up-to-date

Continuous improvement is a cornerstone of sustainability. It is important to stay informed about emerging trends and evolving priorities in your industry. Utilise benchmarking tools such as the CSA benchmarking database to assess top performers and glean insights from their strategies. Reflect on the following:

- Who are the top performers in our industry?

- What makes them stand out?

- What reporting frameworks and standards are peers adopting and reporting against?

- What emerging topics has S&P Global identified? (Check out the future questions section in the CSA portal)

Remaining current with industry trends ensures that your company maintains a competitive edge in sustainability practices.

How we can support you

Amidst the major shifts in the global ESG reporting landscape, including the development of the International Sustainability Standards Board (ISSB) Standards, the European Sustainability Reporting Standards (ESRS), and the upcoming Australian Sustainability Reporting Standards (ASRS Standards), the heightened scrutiny in this year’s CSA comes as no surprise. With such developments, it is now more crucial than ever to take the time to understand your CSA results and leverage your performance on ESG ratings for enhanced ESG disclosures.

At SLR, our global team possesses a wealth of expertise in ESG reporting and disclosure, offering comprehensive support throughout your CSA journey, including:

- Conducting gap analyses to understand historical performance and key areas for improvement;

- Supporting companies with internal engagement and data collection using our bespoke CSA tools;

- Analysing and benchmarking scores to create a clear roadmap for improvement.

Get in touch with our global CSA experts for further information:

Charlie Hodkinson-Ashford

Director, ESG Strategic Advisory - North America

Germán Saenz

Director, ESG Strategic Advisory - South America

Peter Truesdale

Director, ESG Strategic Advisory – Europe

Miguel Oyarbide

Technical Discipline Manager, ESG Strategic Advisory – Asia Pacific