Cultural heritage: Indigenous and cultural heritage values driving sustainable development

by Flavia Kiperman

View post

On March 06, 2024, the U.S. Securities and Exchange Commission (SEC) adopted its final rules requiring publicly listed companies in the U.S. to disclose climate-related information in their financial filings.

On April 4, 2024, less than a full month after issuing the rules, the SEC paused their implementation, pending a judicial review in the U.S. Court of Appeals. The pause is due to legal challenges from both sides of the socio-political spectrum. On one hand, Republican states and many business groups are opposing the rules on the grounds of SEC overreach, and on the other, environmental groups like the Natural Resources Defense Council argue that the rule doesn’t go far enough.

The SEC states that it’ll “vigorously defend” the rules, as they’re in line with applicable law and its authority. While impacted stakeholders must now await the outcome of the judicial review, it’s still important to understand, and prepare for the proposed disclosure requirements.

This article gives an overview of the latest developments on the rules, their (current) proposed requirements, as well as the implications for Canadian companies listed on U.S. stock exchanges.

SLR will continue to update this article to bring you the latest developments of these rules.

The proposed SEC climate disclosure rules aim to provide investors with more consistent, comparable, and reliable information about the financial effects of climate-related risks on business operations. SEC-registered companies will be required to disclose how they identify, manage, and oversee climate-related risks, and their scope 1 and 2 emissions (only if they’re material to the business¹).

The final rules are much leaner than the original draft published in 2022. The SEC combed through over 24,000 comments and 4,500 unique letters as it worked on the final version. Even in their watered-down form, the proposed requirements still set the stage for mandated, standardized climate-related disclosures for domestic and foreign, publicly listed companies in the U.S., including Canadian companies.

¹The SEC derives its definition of ‘materiality’ from the U.S. Supreme Court Precedent. Materiality in this context means that information is material if it would be important for a reasonable investor to make an investment decision, or if its omission would significantly alter the total mix of information.

It’s estimated that over 200 Canadian companies will be affected by these rules. If your Canadian company is registered with the SEC, it’s important you know what you’ll need to disclose and by when.

The SEC maintains it will “vigorously defend” the final rules. SEC registrants and all other interested parties will have to wait for the outcome of the judicial review process. In the meantime, many large U.S. and Canadian companies are getting ready to comply with similar rules in other jurisdictions, like California and the European Union.

The rules apply (in part or in whole) to all SEC-registered foreign and domestic companies. The level of disclosure will depend on the registrant classification of your company (i.e., whether you’re a large accelerated filer or accelerated filer, for instance).

Yes. Canadian SEC-registered companies that use the Multijurisdictional Disclosure System (MJDS) to file annual reports under the Exchange Act are exempt from the Climate Disclosure Rule.

If you need clarification about the SEC rules applying to your company or your classification status, consult your legal or financial team.

Narrative Disclosure: Affected entities under the rules must provide narrative discussion on the following topics:

Scope 1 and 2 Emissions: Reporting on Scope 1 and 2 emissions will be required for companies categorized as “large accelerated filers” and “accelerated filers” only if GHG emissions are material, and the company is not otherwise exempt. Scope 3 emissions have been left out of the final rule.

Large Accelerated Filers and Accelerated Filers will be required to have limited assurance for their scope 1 and 2 emissions data for their second and third year of reporting under the rule, and reasonable assurance in the fourth reporting year and beyond¹.

¹For a detailed description on limited and reasonable sustainability assurance, read here.

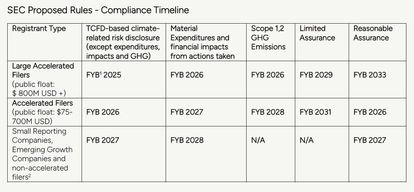

The final SEC rules extend many of the effective dates initially proposed. The SEC has also added more phase-in periods for certain disclosure requirements and some filers.

¹ FYB = fiscal year beginning (assuming a calendar year-end).

² For more information on how the SEC classifies registrants, read here.

Find a more detailed breakdown of the climate-related disclosure requirements in this article by our U.S. Director of Strategic Advisory, Joanie Baczewski.

The SEC rules are paused but not cancelled. Regardless of the regulatory uncertainty, the time is ticking for SEC-registered companies to prepare for these proposed disclosure requirements. Utilize the additional transition time to identify your data requirements, assess your disclosure capabilities, and ensure you are ready to report on all the requested information.

How SLR Can Help SEC-Registered Companies prepare for the SEC Rule

Once the SEC rules are finalized, they will usher in a new era of mandatory sustainability-related disclosure in the U.S. This may require a shift in your ESG strategy and disclosure process. Our ESG Advisory team is ready to help you with preparing for SEC’s disclosure requirements by:

Interested in learning more? Register for our May 2 webinar, ESG Disclosure Updates in the U.S. and Canada: Bringing Your Business Up to Speed.

by Flavia Kiperman

by Jasper Schrijvers , Matthew Hoare

by Clodagh Connolly, Nicola Inge, Andres Schottlaender